What to know when the unexpected happens

Below, you’ll find information about various worker’s comp, disability, accident, and illness information designed to support you in your time of need.

Worker’s Comp

New Workers’ Compensation Process & Forms 2024-2025

Effective July 1, 2024, Athens Administrators began administering the care and handling of all workers’ compensation plans on behalf of the City of La Mesa, replacing our former provider, CorVel. This change was a decision made by our risk pool, Public Entity Risk Management Authority (PERMA), to provide more responsive care to employees. All work injuries must be reported within 24-hours of their occurrence or when the employee first reports it.

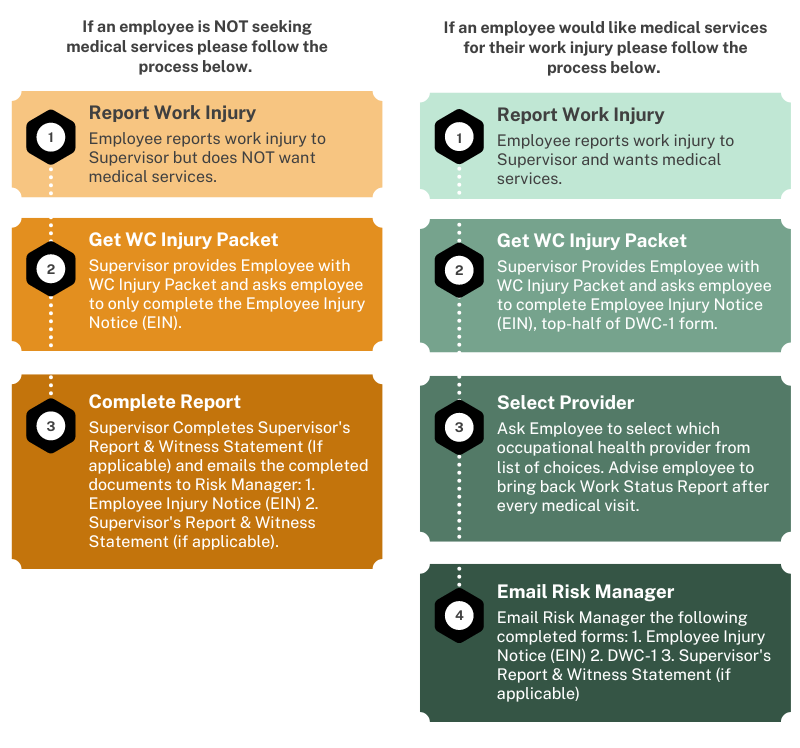

The following are the forms you may find on the intranet under Risk Management, along with a process flow chart.

- 1. WC Employee Injury Packet-NEW Forms-to be provided to employee reporting a work injury.

- 2. Employee Injury Notice– NEW Form-to be completed by the employee whether they are seeking medical services or not.

- 3. DWC-1 form-the top-half to be completed by employee and bottom-half completed by supervisor ONLY when the employee is seeking medical services.

- 4. Supervisor’s Report-NEW Form-to be completed by supervisor for all reported work injuries.

- 5. Witness Report of Injury-to be completed by witness to incident related to employee injury, if applicable.

Questions? Contact Beatriz Cruz Rivera at 619-667-1178 or

Disability Insurance Coverage

The goal of the City of La Mesa’s Disability Insurance Plan is to provide you with income replacement should you become disabled and unable to work due to a non work-related illness or injury. City of La Mesa provides eligible regular management employees with disability income benefits through The Standard Insurance Company at no cost to you. Benefits begin after 30 days of disability or illness.

Voluntary Accident and Critical Illness Coverage (BR)

The City of La Mesa offers additional (voluntary) benefits through The Standard. If you are interested in enrolling in any of these benefits, you may do so during this open enrollment period.

Personal Accident Indemnity Plan: Features benefits for emergency treatment, follow-up treatment, initial hospitalization, hospital confinement, ambulance benefit, physical therapy, accidental death,

Personal Critical Illness Indemnity Plan: Features benefits for enhanced critical illnesses and health maintenance screening benefits.

Group Basic Life and Accidental Death and Dismemberment Insurance

Group Basic Life insurance from Standard Insurance Company helps provide financial protection by promising to pay a benefit in the event of an eligible member’s, or his or her dependent’s covered death. Basic Accidental Death and Dismemberment (AD&D) insurance may provide an additional amount in the event of a covered death or dismemberment as a result of an accident.

The cost of this insurance is paid by City of La Mesa, except for the cost of your dependent’s insurance, which is paid by you through payroll deduction. Enrollment materials needed to elect coverage will be provided.

Eligibility

Definition of a Member

You are a member if you are an active employee of City of La Mesa and regularly working at least 30 hours each week. You are not a member if you are a temporary or seasonal employee, a full-time member of the armed forces, a leased employee or an independent contractor.

Class 1 – All Full-time employees, excluding Managers

Class Definition

Class 1 – All Full-time employees, excluding Managers

Eligibility Waiting Period

You are eligible on the first of the month that follows the date you become a member. Your dependents will need to provide acceptable evidence of good health if you elect coverage after initially becoming eligible.

Benefits

Basic Life Coverage Amount

1 times your annual earnings to a maximum of $175,000, with a minimum benefit amount of $25,000.

Basic AD&D Coverage Amount

For a covered accidental loss of life, your Basic AD&D coverage amount is equal to your Basic Life coverage amount. For other covered losses, a percentage of this benefit will be payable.

Life and AD&D Age Reductions

Basic Life and AD&D insurance coverage amount reduces to 60 percent at age 70, to 40 percent at age 75 and to 30 percent at age 80.

Basic Dependents Life Coverage Amount

The Basic Dependents Life coverage amount for your eligible spouse is $5,000. Your spouse is the person to whom you are legally married, or your domestic partner as recognized by law or by your employer’s domestic partnership policy, if applicable. The Basic Dependents Life coverage amount for each of your eligible children is $2,500. Child means your child from live birth through age 25.

Other Basic Life Features and Services

- Accelerated Benefit

- Right to Convert Provision

- Life Services Toolkit

- Standard Secure Access account payment option

- Portability of Insurance Provision

- Travel Assistance

- Repatriation Benefit

- Waiver of Premium

Other Basic AD&D Features

- Air Bag Benefit

- Family Benefits Package

- Line of Duty Benefit

- Seat Belt Benefit

About This Information

This information is only a brief description of the group Basic Life/AD&D and Basic Dependents Life insurance policy sponsored by City of La Mesa. The controlling provisions will be in the group policy issued by The Standard. The group policy contains a detailed description of the limitations, reductions in benefits, exclusions and when The Standard and City of La Mesa may increase the cost of coverage, amend or cancel the policy. A group certificate of insurance that describes the terms and conditions of the group policy is available for those who become insured according to its terms. For costs and more complete details of coverage, contact your human resources representative.